in house financing meaning

In-house financing is financing in which a firm extends customers a loan allowing them to purchase its goods or services. What Does In-House Financing Mean.

The Main Difference Between A Pre Approval And A Loan Application Is That There Is No Specific Property When A Pre A Home Mortgage Buying First Home Home Loans

Available for purchase or refinance.

. Save on monthly payments when you purchase your home with Langley. 10 Down Payment Options with No Mortgage Insurance. In-House Financing vs Traditional Financing Owings Auto.

Typically these interest rates are fixed and given at a range between 14 to 18. Pros for Buyers. An early morning fire killed one adult and injured two residents of a home in Ashburn Virginia Tuesday morning.

Primary second home and investment properties. You may be wondering what is in-house financing for cars. In house lending is a type of seller financing in which a company or broker will help a customer obtain a loan at their place of business to purchase any product or services.

In-house financing means that you borrow money directly from the dealership to finance your new vehicle. How Much Money Can You Save By Refinancing Your Home Loan. In-house financing simply means that you borrow money from your car dealership.

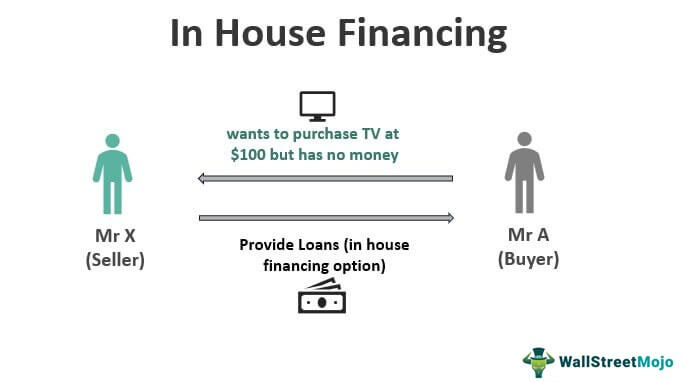

Compared to a bank loan in-house. In-house financing is done when the buyer wants to buy something but they dont have enough money to purchase the product and the seller gives them a loan for that product. In-house financing just means that we handle all the financing for the vehicles we sell.

Essentially in-house financing is when you obtain financing from a dealership. No need to visit a bank to. We take care of all the paperwork make the loans and collect the payments.

Ad 2022s Latest Online Mortgages. In House Car Financing Meaning. In-House Car Financing Meaning.

An auto loan is a contract in which a lender agrees to finance your new or used vehicle. Ad Get Mortgage Refinance Rates Rates Are Still Low Top 5 Mortgage Refi Lenders for 2022. Compare Refi Lenders for 2022.

Ad Multiple loan options with low rates offer you flexibility needed for your first purchase. Comparisons Trusted by 45000000. Depending on your credit situation and needs in-house financing can be a great option if you.

With in-house financing you dont have to go through a bank to fill out a credit. The fire sparked just before 130 am. To be eligible you need to meet the criteria set out by the lender.

In-house financing is taking out a loan directly from the property developer to acquire a condominium a townhouse or a house and lot. The interest rates for in-house financing are generally higher compared to banks. In-house financing is when you possess your car directly from a private lender or a dealership.

In-house financing is a type of loan provided by a business directly to a customer allowing them to purchase goods and services offered by the business. Often called buy here pay here dealerships in-house financing dealerships let you buy. Brunos Bounce House have been providing perfect equipment rentals to the Ashburn VA area for a long time so you can trust us with handling your bounce house rental needs.

Financing directly with your car. No bank fees or. How Much Money Can You Save By Refinancing Your Home Loan.

You then make loan and interest payments to the dealership. In-House Financing Definition Investopedia. In-house financing allows borrowers to take out a loan directly from the retailer to pay for a high-ticket item rather than turning to third-party finance companies with more.

Ad Low Down Payment Jumbo Mortgage Loans. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Compare Refi Lenders for 2022.

In-house financing can be convenient but make sure to weigh the disadvantages before taking on in-house financing for an auto loan. In-house financing is a form of financing where the business that sells a specific product or. This kind of financing.

In-house financing reduces the firms dependency on the banking sector to provide monies to the client in order for the transaction to be completed. As the name implies its when the dealership extends a loan directly to you rather than. In-house financing is a lending option provided by the company that sells you the product or service.

In-house financing dealerships sell cars and fund auto loans all in one place. No waiting for the bank loan officer underwriter and legal department to process and approve the application. With in-house financing the.

Updated November 13 2021. Dealerships with in-house Financing can also drive quicker and be more affordable than most loans meaning you can get on the road in the next vehicle. This can be a potential option for those shoppers who dont have a high.

Ad Get Mortgage Refinance Rates Rates Are Still Low Top 5 Mortgage Refi Lenders for 2022.

Bridge Loan Meaning Features How It Works Pros And Cons In 2022 Bridge Loan Money Management Advice Accounting And Finance

Increases In Confirming Loan Amount Limits Across The State Means You Can Get The Lowest Rate Possible Inspite Of Increasing Home Buying Home Loans Loan Amount

In House Financing Meaning Example How Does It Work

Low Down Payment And First Time Home Buyer Programs 2019 Edition First Time Home Buyers Down Payment Mortgage Payoff

Build Or Buy A House In 2022 Building A House House Search Renting A House

Mortgage Pre Qualification Vs Pre Approval What It Means And Why It Matters In 2022 Mortgage Real Estate Advice First Time Home Buyers

Compromises Must Be Made When Creating A Tiny Home There S No Room For A Full Kitchen Or Bathroom But One Lo Small Cabin Tiny House Movement Tiny House Cabin

Do S Don Ts For The Ideal Mortgage Mortgage Brokers House In The Hamptons Work Smarter

Mortgage A Mortgage Is A Loan Provided By A Bank Or A Financial Institution For Buying Residential Economics Lessons Financial Literacy Lessons Accounting And Finance

Bond Vs Loan Head To Head Difference Loan Bond Infographic

What To Do Before Buying A Home Buying First Home Home Buying Buying Your First Home

Mortgage Underwriters Meaning Useful Factors Outcomes And More Underwriting Accounting Principles Mortgage

Real Estate Terms Real Estate Terms Appraisal Home Inspection

Ultimate Home Buyers Checklist Save Time Money Mortgage Loans House Down Payment Saving Money

Guide To Long Term Financing Definition Here We Discuss The Top 5 Sources Of Long Term Financing Along With Exam Long Term Financing Finance Investing Finance

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)